💡 This post is a continuation of my previous post How to Save on Auto Insurance in Under 5 Minutes, after realizing that my process wasn’t as simple as I had expected and that I needed a separate post to write about this 🤦🏼♂️.

Summary

- It’s never been harder and more expensive for drivers in California to purchase auto insurance today.

- Insurance brokers can’t help much and they seem to be discouraged by the lack of availability as well.

- Reasonable options are GEICO (need to jump through hoops), AAA (expensive), and Tesla insurance (for Tesla owners) – each come with own caveats.

Starting with GEICO

Now that I had a good sense of what coverage I wanted to decrease to lower my insurance premium, I tried actually to purchase my policy.

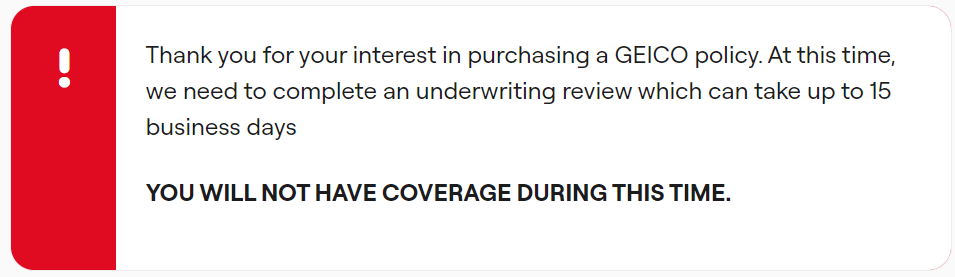

To my disappointment, I found out that I wasn’t able to complete my purchase all online and it would take me more than 15 business days to complete an underwriting review (Below is a screenshot).

While I had just over 15 business days until my policy expires, I didn’t feel comfortable with the uncertainty of not being able to lock in my insurance policy.

Next – finding an insurance broker

This led me to doing some research on Yelp and Google to see which insurance broker I could work with.

I reached out to two regional brokers with high ratings, good reviews, a large number of insurance carriers that they work with and heard back from two of them.

I asked for their pricing and quotes. One of the brokers told me that my quote got blocked and that the insurance company wasn’t able to provide a reason.

He told me that ~80% of new auto insurance requests were getting blocked recently from his conversations with other insurance brokers. I was subsequently redirected to try AAA.

Next – working with AAA

I filled out all my info online and the quote at AAA was a lot higher than I was expecting at $6,578 a year with lower coverage levels.

I wanted to see if I could speak with someone and tweak the parameters to lower my premium, so I spoke with someone from the closest AAA branch.

He told me upfront that CA rates are much different from those in WA. He had to adjust some parameters based on my information, like switching the primary policyholder, which helped surprisingly.

Below are some nuggets of information from my 40-minute conversation with the agent (he was great).

His suggestion was that I adjust the year of first license to when I was first licensed outside of the country, because the system doesn’t have an override for people that have lived abroad.

Typical quote for Tesla owners is $3.8-4.4k in this area. He suggested Tesla Insurance or asking Progressive for a transfer to CA from WA.

He tried taking out the uninsured deductible waiver. This helped a little bit.

He recommended that he could try getting the mileage discount; essentially in 90 days, I can provide him with my actual mileage, he would multiply this by 4 and see if he can get it under 4,500, this could save ~$200 in 90 days but not immediately.

I was informed that I could remove uninsured and underinsured motorist bodily injury because I don’t commute so the risk is low.

$3,658 was the total.

Trying my luck with Progressive and Telsa

I tried contacting my insurance agency up in WA, they weren’t able to do a transfer and Progressive told me via my agent to try calling two agencies in my area.

I called one and was told that they weren’t writing new personal auto insurance policies in the market. I stopped there since I felt like I was wasting my time.

With Tesla Insurance, I wasn’t able to proceed beyond a certain point due to some lag or technical difficulties. I decided that there wasn’t much I could do right now.

This led me to go back to my GEICO quote.

Finally, back to full circle with GEICO

I pulled up my quote again and went ahead with the payment information. However, there was no email confirmation or anything I could follow up with and I noticed that many people had experienced the same issue and had some success calling GEICO directly to expedite the process (link to Reddit discussion here).

I tried calling GEICO and was told that I should receive a physical mail with instructions within 15 business days and that the whole process should take under 30 business days. The rep told me over the phone that I should be able to still get a policy absent events like license suspension.

Because my existing WA was set to expire in less than 30 business days, I called my insurance agent up in WA to see if it’s ok for me to renew my policy in CA. The agent informed me to renew and cancel later (caveat that there’s a ~$30 penalty) but to not change the location that my car is garaged (they could cancel my policy apparently). I did refer to this article from Bankrate for some basic information as well.

Typically, insurance agents advise you to get switch auto insurance before moving and then register your auto later.

But, I wasn’t able to find someone to work with in CA before moving, and CA state fines new residents for failing to register their auto within 20 days of establishing residency but I was not aware of any penalties from the state or insurance company for failing to transfer or purchase a policy in the new state.

So, I temporarily lowered my premium by increasing my deductibles and paying the full amount upfront and patiently waited for the letter from GEICO to arrive in the mail.

I haven’t found hard facts on this but many people including myself are suspecting that GEICO wants to discourage consumers from getting insurance policies in CA (interesting Reddit discussion here).

Finally, the letter from GEICO requesting more information arrived (below is a redacted scan for privacy reasons) just short of 15 business days. I responded to the letter via email (I had the option to respond via email or mail) the same day that I received it (I replied 7 days from the date of the letter).

On 2/28, I received another letter in the mail that my request for policy is closed because the information was incomplete, or they didn’t receive the requested information. The letter was dated 2/21.

I called the number at the bottom of the letter to check what was up. The rep that I spoke with told me that my application is still current despite the letter (this is an automated letter) but that the team did not receive my documentation.

It turns out that I sent the email to the wrong email address (R4C4 instead of R4CA 🤦🏼♂️) so I sent an email again to the correct address and received an automated reply confirming receipt.

On 3/16, I received a letter dated 3/8 saying that my application has incomplete information or additional information has not been submitted.

On the next weekday, 3/18, I called the number on the letter and was almost instantly connected to a person in the underwriting department. The gentleman informed me that they need copies of my and my wife’s driver’s licenses.

Subsequent to this phone conversation, I promptly submitted copies of our driver’s licenses to the same R4CA email and got an autoreply that it received my email.

As of the date of writing this post, I am still waiting to hear back from GEICO after a close to two-month process. I actually might have to try harder getting a quote from Tesla Insurance at this point.

Concluding remarks

As you may have noticed, I’m not finished with the processing of getting auto insurance in California.

I’m hoping that GEICO will follow through with my application, if not I will try my luck with Tesla Insurance on its app again and post any updates here.